Businesses beware: the payments landscape is changing. 2024’s payment trends show ongoing change and structural shifts towards different kinds of electronic payments, both B2B and B2C and across industries.

These trends promise increased payment efficiency and revenue growth – that is if companies can successfully leverage new technologies.

The COVID-19 pandemic drove a significant increase in the adoption of digital payments, as consumers and businesses adapted to new ways of living and working.

As a result, traditional payments are in decline. Cash comprised only 16% of point-of-sale transactions in 2022. In their Payments Report 2023, financial corporation FIS Global projects a -6% compound annual growth rate (CAGR) in cash POS transactions through 2026, as consumers gravitate to the ease, convenience, and safety of digital payments.

Source: FIS Global

Traditional B2B payment methods like checks have declined, too. While commercial check payments were still valued at $8.9 trillion in 2022, their volume decreased by 7,8% from the previous year, according to the FED.

But the changing payment landscape is not so much a story of old payment methods going out of fashion – it’s a case of new technologies innovating customer experience and driving business growth.

Consumers are increasingly open to new technologies and the convenience of digital payments, and companies embrace the integration of financial services into their ecosystem through embedded finance and fintech. And with that, digital payment is replacing old systems.

Over the past five years, electronic transactions have grown compared to overall payments revenue.

McKinsey’s 2023 Global Payments Report notes that the increase in electronic payments transaction volumes has consistently outpaced payments revenue growth over the past five years, with electronic transactions growing at a rate of 17 percent versus a six percent growth in total payment revenue.

This is indicative of the continuing evolution towards new technologies. But what trends in the payment industry drive this growth?

Forget the long-term trend forecasts and speculations, let’s look at what payment industry trends are shaping 2024 and the coming years.

We see trends that signify transformative industry shifts, while others are disruptive waves taking the payment landscape by storm. Still other trends are emerging ripples that come with big ramifications.

We’ll cover these 8 big payments trends to watch in 2024, ranked according to their immediate influence on the payments industry:

Seismic shifts: What’s transforming financial services in 2024

- Digital wallets and payments are mainstreaming

- Wider adoption of real-time payment methods

- B2B e-commerce goes hybrid

Making waves: Disruptive payment trends to watch in 2024

- Buy now pay later (BNPL) becomes more popular

- Pay-by-bank services (A2A) gain momentum

- Payroll cards see higher adoption

Ripple effect: What are the emerging trends in payments in 2024 and beyond?

- Digital currencies get push from central banks

- More focus on security and privacy

Read on to learn more about 2024’s payment trends.

Is your company working to adapt to this wave of payment trends? Schedule a free assessment with us to explore tailored payment card strategies.

Seismic shifts: What’s transforming the payment landscape in 2024

These foundational trends drive and reflect the ongoing digital transformation of the payments industry and the increasing adoption of new technologies to make payments more convenient, efficient, and secure.

1. Digital wallets and payments are mainstreaming

Already a huge consumer payment trend, digital payments have seen tremendous growth in recent years, with more than nine out of 10 consumers having used some form of digital payment over the course of the year, according to McKinsey’s Global Payments Report.

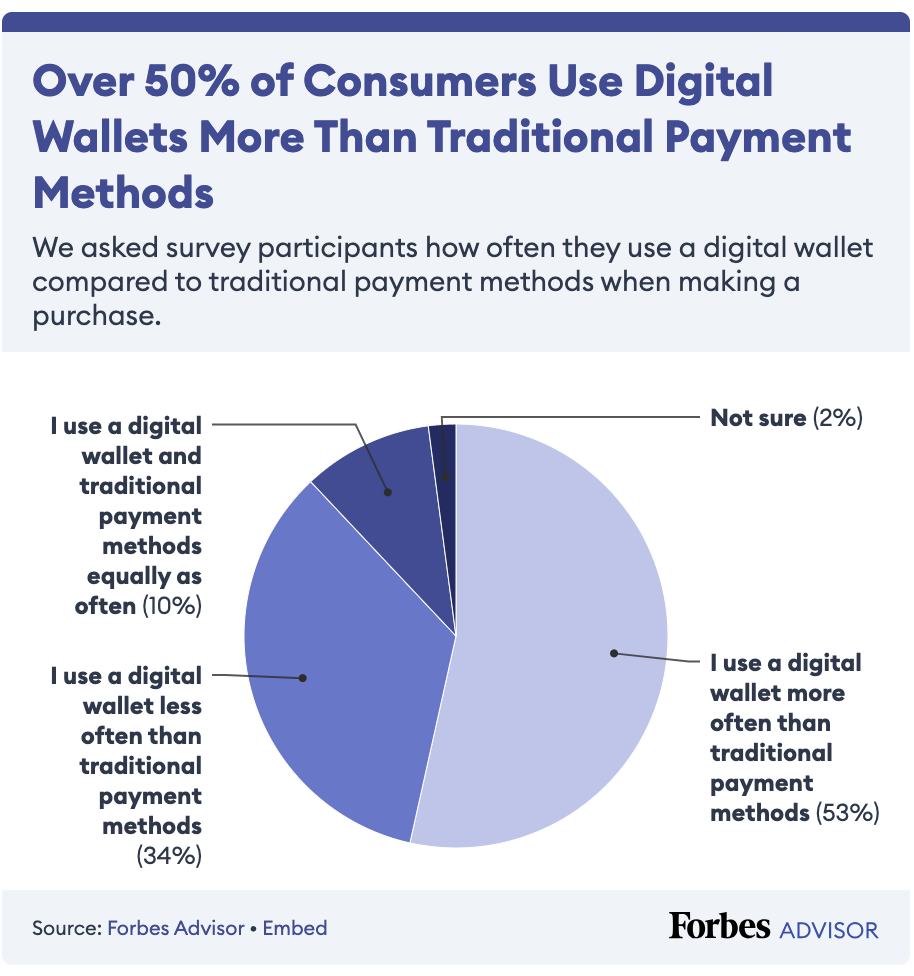

When asked by Forbes, 53% of US respondents said they used digital wallets more than traditional payment methods, like cash or physical debit cards and credit cards. And 72% of respondents stated they would consider using digital wallets as their primary payment method for shopping.

Source: Forbes

With the rise of digital wallets, mobile payments are seeing an increase in usage as merchants more readily accept payments with mobile wallets and financial services like Google Pay and Apple Pay, as well as the use of in-store capabilities for QR-code or contactless payments.

With wide consumer adoption, digital wallets remain among the fastest-growing payment methods with 15% CAGR at point-of-sale and 12% annual growth in e-commerce forecast through 2026, states the earlier mentioned FIS report.

As B2C embraces more digital payments, it’s only a matter of time for B2B markets to follow suit.

B2B is following suit with digital wallet use

The popularity of digital wallets among consumers shows that efficiency and convenience resonate universally across user types – including in commercial contexts.

It’s a misconception to think that digital wallet capabilities are catered more to consumer money transfers and micro-purchases. The future potential for digital wallets to support B2B payments should also not be underestimated, notes Bank of America.

A major business use case for digital wallets lies in industries with independent contractors who expect on-demand payment, B2B wallets increase payment options, with tokenized account details stored in a digital wallet simplifying repeat payouts while ensuring sensitive bank account and routing numbers stay protected.

For procurement use cases, virtual single-use credit cards improve security and accounting categorization for ad hoc item orders. Where vendor master data needs continual updating, aliases also reduce administrative overhead.

Digital wallets have the potential to make business payments more data-rich, configurable and secure through open banking.

And with specialty payment providers equipped to cater to vertical needs, using these digital payment tools will become more relevant in embedded business workflows in 2024.

2. Wider adoption of real-time payment methods

One of the biggest payment industry trends, real-time payments (RTPs) are financial transfers initiated and settled almost instantly, rather than waiting days for settlement finality.

In a 2023 survey done by the financial corporation U.S. Bank, 68% of over 1,000 CFO respondents intend to use RTPs two years from now.

That’s over double of the 41% of US companies that already used this ultra-fast payment processing method to some extent in 2022, according to a joint report by payments media PYMNTS and Mastercard.

Businesses in the survey adopted RTPs, known as instant payments in Europe, primarily for being able to send and receive payments 24/7/365.

Source: PYMTS

Up to recently, RTPs in the US were primarily provided by private operator The Clearing House’s RTP (real-time payment rails) network. However, the Federal Reserve introduced its own real-time payment system in July 2023.

With the Fed having just launched instantaneous payment processing and the ability to change US banking infrastructure, there is much more potential growth awaiting this new technology. As reported by the publication CFO, business leaders would do well to adopt RTPs early on for several strong reasons:

- Instant speed enables urgent B2B payments and reduces settlement risk. Rapid access to funds better manages unforeseen liquidity events or supply chain hiccups.

- Rich transaction data improves reconciliation and cash flow visibility. Embedding supplier IDs, SKUs, invoice details directly into payments slashes manual matching efforts.

- Lower costs than wires with faster settlement than ACH. RTPs offer the best aspects of wires (speed) and ACH (price) to optimize back-office spend based on need.

- Precise control over payment timing enhances working capital efficiency. Companies gain levers to align outlay timing with inflow receivables to improve net position.

- Emerging features like Requests for Payment (RfP) further optimize processes. Functionality like real-time supplier invoices and customer account credits increase automation.

As the above breakdown indicates, RTP adoption goes beyond marketing buzzwords of speed and efficiency. With the Fed pushing their instant payment service with major banks, this RTP rail will soon permeate the global payments infrastructure.

The time for businesses to start using real-time payment is now.

3. B2B e-commerce goes hybrid

The COVID-19 pandemic significantly impacted consumer behavior, leading to a surge in e-commerce sales. E-commerce sales increased by $244 billion or 43% in 2020, the United States Census Bureau reports from a survey.

More than a temporary trend in consumer behavior, this increase signaled an ongoing shift in shopping preferences.

According to a PwC publication, 89% of banks believe that the shift towards e-commerce will continue to increase, reflecting the growing influence of online shopping and digital platforms on payment trends.

Across B2B markets, e-commerce has also seen a surge in recent years, growing 19% in 2022. E-commerce publisher Digital Commerce 360 reports that B2B e-com grew faster than total B2B sales in that year, accounting for 13% of all manufacturing and distribution sales.

The North American B2B e-commerce market is expected to grow another 19% until 2030, according to consulting company Grand View Research.

Source: Grand View Research

This growth is reflected in buyers’ preferences. 83% of B2B buyers prefer placing orders or paying for goods through digital channels, and research firm Gartner predicts that by 2025, 80% of B2B sales interactions between suppliers and buyers will occur in digital channels.

So what’s in store for B2B e-commerce in 2024? As buyers become more efficient at using new payment methods and online platforms to drive their purchases, B2B e-commerce platforms scramble to improve their customer experience to meet the markets’ needs.

B2B e-com trends that buyers can look forward to in the coming year are:

- Self-service buying outpaces human interactions, as buyers increasingly prefer to direct their own buying decisions, as reported by McKinsey. This requires B2B sellers to adopt a more omnichannel approach to be present at each buyer step.

- B2B e-commerce shopping experiences become more like B2C customer experiences. This includes clear pricing information, real-time inventory availability, transparency around sales claims, and tailored content for specific buying stages, groups, and people.

- New technologies used in B2B e-com platforms facilitate these buyer preferences. These technologies include headless commerce, integrations, and multi-channel support, to simplify the complex process of selling online without human interaction.

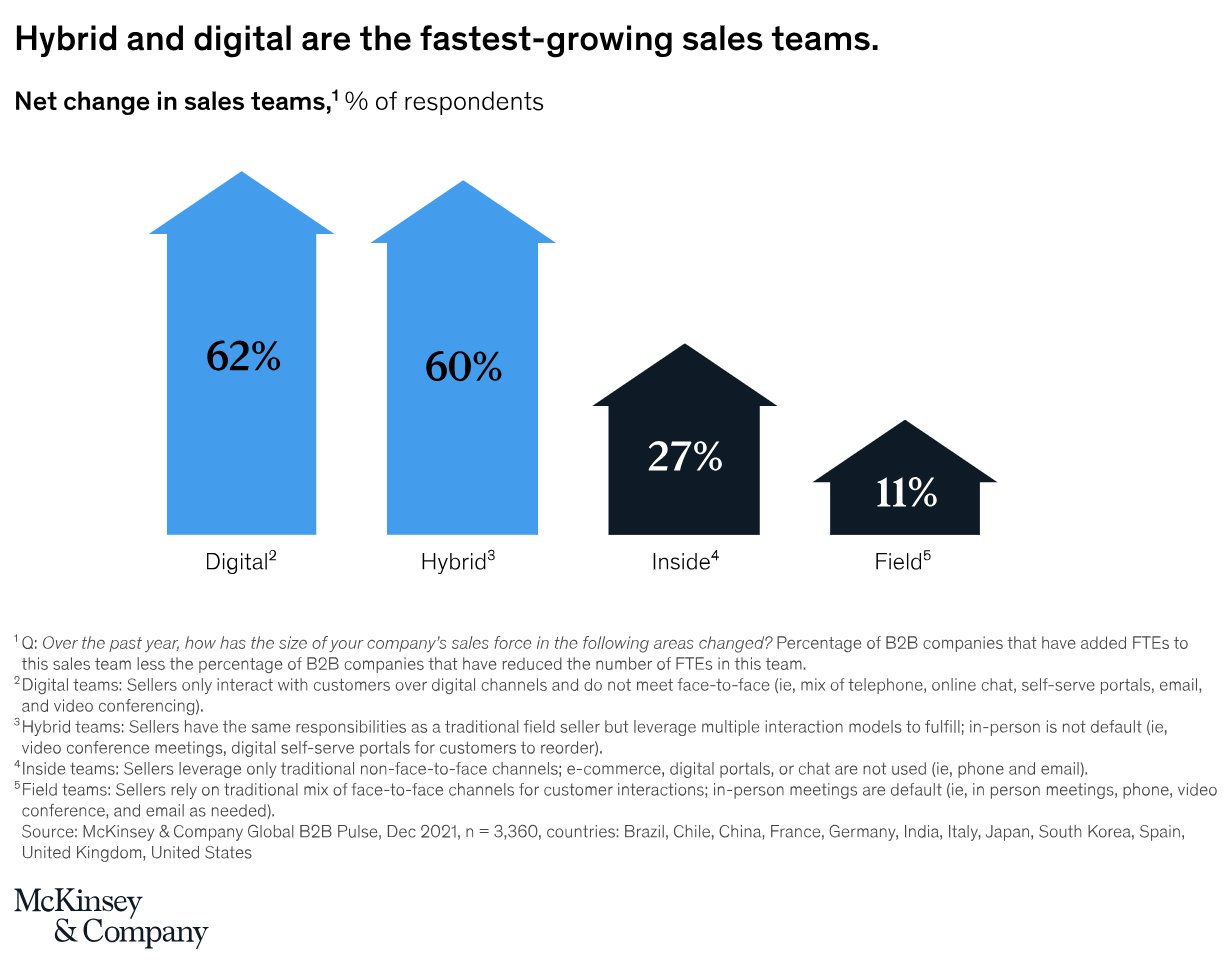

- As a result of these buyer preferences, B2B e-com platforms will shift to predominantly hybrid experience in 2024 and the coming years. Hybrid sales drive up to 50 percent more revenue by enabling broader, deeper customer engagement and unlocking a more diverse talent pool than more traditional models.

Source: McKinsey

Rather than offering a completely automated customer experience, hybrid selling is expected to be the most dominant sales strategy by 2024 due to the shifts in customer preferences and remote-first engagement. So what does it mean for B2B payment trends?

This e-com shift forces more B2B payment diversification and flexibility to match e-commerce customer preferences.

As channels multiply, businesses must support digital and remote payment options beyond past norms to thrive. Investing in optimized self-service payment tech ensures a secure and seamless purchasing experience that engenders loyalty.

Utilizing interaction data will become crucial for creating tailored payment experiences across channels that cater to how B2C-like B2B customers want to pay.

Making waves: Disruptive payment trends in 2024

The following three trends represent disruptive trends reshaping payments by introducing new technologies, experiences and business models across verticals.

While not as foundational as structural shifts, these innovations display sharp growth that competes with legacy payment flows. Their rising preference forces financial institutions and merchants to adapt quickly or risk falling behind consumer and business expectations.

4. Buy now pay later (BNPL) becomes more popular

A fintech solution offered across many online platforms, ‘buy now, pay later’ has already taken the consumer payment industry by storm. In FIS' Global Payments Report 2023, BNPL accounted for 5 percent of global e-commerce transaction volume last year.

And like other innovations from the consumer market driving B2B payment trends, BNPL payment methods are increasingly used to settle business payments, with major players like Amazon Business and Affirm entering the market.

BNPL offers many of the same benefits for businesses as it has for consumers, states a joint research between PYMNTS and BNPL provider Splitit.

The absence of or comparatively low interest payments is a hugely beneficial feature that is tied to BNPL, especially since traditional credit products can charge businesses up to a 60% annual percentage rate (APR).

To avoid high interest rates, about two-thirds of business owners have to cover business expenses with personal funds. This hints that the market is there to tap other ways of paying for supplies, inventory, and keeping unplanned expenses affordable.

In an article by venture capital firm Bain Capital Ventures, BNPL industry leaders note how buy now pay later has the potential to replace traditional credit options.

To implement BNPL, B2B marketplaces can either build the capability themselves or establish a partnership with BNPL providers that manage the entire end-to-end process.

BNPL for B2B marketplaces holds great promise for almost every business sector, offering customers a low-cost way to finance purchases and sellers a safe, data-driven way to collect payment.

While BNPL for B2B is still in its early stages, it is expected to grow as B2B marketplaces adopt the technology and partner with the right infrastructure partners.

5. Pay-by-bank services (A2A) gain momentum

Also known as account-to-account (A2A) payments, pay-by-bank services are taking off in a variety of public, private, and hybrid models, and in a number of countries in Europe and around the world.

Source: FIS Global

For both B2B and B2C merchants, A2A payments reduce the cost of payment acceptance while improving cash flow with immediate availability of funds through RTP rails, concludes FIS in their Fintech Insights report.

These direct payments between bank accounts offer lower costs than most methods, especially card payments, which is exciting for merchants of every size and type of business around the world.

Another benefit, A2A payments prioritize security and regulatory compliance, particularly with strong customer authentication protocols in Europe and other regulated markets, which is beneficial for businesses operating in multiple markets.

A2A payments have been available for both merchants and users for some years now, but businesses lagged behind because A2A did not offer little flexibility and benefits beyond what would be given by card companies.

Open banking has changed that, notes account service provider Host Merchant Services, by allowing third-party financial service providers to access A2A APIs and thereby increasing the scope of this payment method and creating new payment products that offer more flexibility for businesses.

While the US has lagged on adoption of pay-by-bank when compared to much of the world, the launch of the Federal Reserve’s FedNow instant payments service is set to catalyze the use of A2A payments in North America in 2024.

6. Payroll cards see higher adoption

As more and more business operations are digitized, so is payroll. The market for online payroll services is growing rapidly. Valued at USD $3 billion in 2022, payroll services are expected to reach a total value of $9.1 billion by 2030, forecasts consulting firm SNS Insider.

Source: SNS Insider

Couple this trend with fintech’s offerings of innovative payment solutions and what you get is the payroll card.

Payroll cards function like debit cards, except funds are loaded by employers on prepaid cards rather than transferred to a personal bank account.

For employers, benefits include cost savings over issuing paper checks, better ability to reverse fraudulent transactions, and access to workforce spending trend data that can inform HR policy.

On the other hand, employees can use the card in-app or contactless through their smartphones, at ATMs and retailers, as well as for online purchases and bill payments.

As this budding financial service matures in 2024 and payroll card adoption accelerates, small businesses and mid-sized firms can leverage this novel but disruptive payment trend.

Seamless integration and complementary capabilities will especially help small businesses both simplify and streamline their payroll processes while cutting costs and improving cashflow, all while offering employees more benefits.

Ripple effect: What are emerging trends in the payments industry?

While subtle in nature today, these nascent innovations and early adoption trends show potential for significant disruption to the financial services ecosystem down the line.

Much like ripples in a pond that seem small at first but signify something big dropping in the water, these emergent shifts portend major shakeups building momentum and gaining prominence more visibly in the coming year(s).

7. Digital currencies get push from central banks

Central banks around the world are piloting and progressing towards issuance of a new technology that will change the monetary system – fiat-backed digital currencies.

In 2023, 131 countries are exploring a Central Bank Digital Currency or CBDC, representing 98 percent of global GDP, according to think tank The Atlantic Council. Compare that to 2020, when only 35 countries were considering a CBDC.

Source: Atlantic Council

While current national virtual currency initiatives range between research phases to pilots, and only a handful are launched, the direction central banks are taking is clear.

Powered by blockchain, CBDCs offer central banks more control over monetary policy as physical banknotes fade.

Based on pilot testing, use cases include faster cross-border payments, B2B payments, easier government-to-person transfers, and the potential to embed programmability and policy directly into money.

But with these functionalities, questions around financial inclusion, data privacy and impact on commercial banks still require consideration before full-scale CBDC launches.

While seemingly far off, digital currency integration in businesses will accelerate quickly once CBDCs are launched. Research firm Juniper Research forecasts more than $213 billion to be transacted annually in CBDCs by 2030.

A new blockchain ecosystem

In parallel, the meteoric rise (and occasionally spectacular fall) of cryptocurrencies as alternative stores of value, investment assets and payments continue marching towards mainstream adoption.

Major institutions like Tesla, Visa and PayPal prove both regulatory and commercial acceptance while, according to publication Coindesk, over one million crypto wallets now hold at least a whole bitcoin.

Connecting these two digital currency spheres, blockchain-based stablecoins pegged 1:1 to fiat provide a bridge for moving money between decentralized DeFi systems and traditional finance.

Between cryptocurrencies, stablecoins, and CBDCs, a new blockchain ecosystem emerges that will shift the way businesses do payments and operate their finances.

While just in their infancy, these new technologies are already hot topics and currencies like bitcoin and various stablecoins are already integrated into many large financial services.

For businesses, 2024 is the time to start testing strategies involving these new payment solutions before they fundamentally alter the financial services industry in the coming years.

8. More focus on security and privacy

The B2B and consumer payment trends we analyzed all point at an increasingly digital and open payment landscape. While this offers many payment options for businesses, it simultaneously poses a question for business leaders. How do all these B2B payments stay secure?

With the use of new technologies, fraud prevention, and ensuring transactions remain secure and customer data stays private is paramount for sustaining consumer and business trust.

There is a growing emphasis on data privacy and security in payments, reports Reuters. For instance, many state-level data privacy laws are set to become effective in 2024, aiming to update the definition of personal information and increase fines for breaches.

At the same time, payments are becoming more secure with the increased use of biometric authentication.

Biometric payment methods, such as fingerprint recognition, facial recognition, and infrared palm-vein scanning, offer higher security levels compared to traditional PINs or passwords.

Juniper Research forecasts that, in 2024, biometric authentication is expected to play a significant role in securing mobile payments, with a projected value of $2.5 trillion in mobile payment transactions.

With more customer data floating around the internet and payment options diversifying, biometric authentication will be crucial in the development of digital identity infrastructure, as it provides a secure and convenient method for verifying a person's identity.

For businesses considering tomorrow’s digital landscape, the integration of biometric data into digital identity systems can enhance security, streamline operational processes, and improve user experience.

Conclusion: Getting in front of 2024’s payment trends

The 8 payments industry trends we analyzed signify an ongoing digital transformation that is rapidly reshaping both consumer behavior and business finance.

To that extent, we see that consumers often act as early adopters of potentially game-changing payment technologies in the B2B sector.

While the discussed trends will all impact payments in the coming year, they each signify changes in the payment landscape at different levels, from structural shifts and disruptive waves to emerging ripples.

For growth-focused companies, adopting modern commercial payment technology unlocks revenue growth and operational efficiency while improving customer experience.

Moreover, 2024 presents a window for adopting new payments systems and future-proofing business for a fundamentally altered financial landscape.

Want advice on how your business can leverage payment trends to optimize operations and profitability? Schedule a free assessment with us to learn more about how you can improve your digital payments with our payment card systems and APIs.