The COVID-19 pandemic changed employer-worker relationships forever, triggering a mass exodus of employees from company roles.

Yet, if the Great Resignation was a turbulent storm, then new, improved loyalty systems, including prepared cards for employees, are the sturdy anchors keeping companies connected to high-value staff.

Reloadable cards may not have been on the minds of business owners a few years ago, but many are seeing them as an important way of retaining skilled workers.

If you’re one of them, you may have considered the idea of prepaid cards for employees, but are unsure about several details, including:

- How exactly prepaid debit cards work, and how they can benefit your business.

- Which card feature is best for your business, be it an expense card, a payroll card, or a rewards program

- How to integrate a prepaid card system into your company’s infrastructure.

Yet, prepaid cards for employees are growing in importance in the US and Canadian business sectors, becoming a long-term business payment trend.

According to research from retirement planning advisors, NAPCO, prepaid business debit cards now make up 81% of all employee rewards programs, far outstripping perks like awards, merchandise, and even additional time off.

“But why?” you might ask. Well, business prepaid cards for employees offer several important benefits for both workers and employers.

First up, employees like to feel valued and perks are a big part of this. As Forbes Council Member Jeanniey Walden wrote recently, “Nothing spells individuality in benefits like paycheck flexibility”.

Payroll cards give workers the chance to receive wage advances and avoid bank fees, including check-cashing fees that can reach up to 10% of a credit check’s value. They can also dodge the monthly fee and transaction fees that come with just having a checking account (and especially a credit card).

Rewards cards, meanwhile, are a way of praising employees for excellent work and incentivizing them to achieve more. Kind words are one thing, but free credit to spend on a treat for yourself is quite another.

Employers, of course, benefit from the boost in morale that these offerings bring about. A happy workforce that feels valued and rewarded is likely to be more productive than a disgruntled and disengaged staff.

Another benefit is that branded cards boost a company’s image. Having the brand logo next to a major card provider like Visa or Mastercard, as with a white-label debit card, is a sign of class, and shows that your company means business to anyone who sees one.

Prepaid cards also help to tackle the headache of employee expenses. Instead of paper receipts and reimbursements, managers can now monitor everything via the white-label fintech platforms that power the cards, simplifying expense tracking and eliminating paperwork.

In short, prepaid cards are a win-win solution for both parties, acting as both a carrot for staff and a handy financial tool that solves several of your business needs at a stroke.

Want to see how prepaid cards for employees can help your business retain top talent? Contact us today to find out how Berkeley’ Payment’s customized staff debit cards can boost worker satisfaction and drive your company to success.

Can I get debit cards for my employees?

Setting up your own prepaid business debit cards may sound like a complicated process, but the rise of digital card platforms has made it easy to integrate them into your company’s management system.

It’s now easy to issue prepaid cards for employees via intuitive digital interfaces in just a few clicks. From a single dashboard, you can top-up funds and track business expenses, as well as access up-to-the-minute data reports.

Your employees enjoy the freedom of making purchases or accessing funds whenever they want, without having to wait around for reimbursements or dealing with complex paperwork.

What makes the best prepaid card for employees?

The booming prepaid employee card market is set to reach $27 billion by 2025, according to research by Javelin, a banking advisory firm. This means there are many competitive solutions out there that give workers power over employee expenses and cash flow.

Yet, for a prepaid card system to outshine its rivals, it needs to score highly on several important criteria, including the following.

Quick rewards

It’s no good promising workers rewards then taking weeks to deliver them - this could even have a negative impact on morale.

Any issuer of modern employee cards must ensure payments appear as quickly as possible, if not instantly.

Not only is this a standard in today’s world of smart payment tech, but it also shows that you’re a switched-on and efficient employer.

Thankfully, many digital prepaid card solutions make instant payments possible as they can skip delays like the ACH clearing process that plague traditional banking methods.

Versatility is key

The needs of a modern employee are varied, and a prepaid card should have the capacity to fulfill many of these.

Let’s say an office worker would like a wage advance instead of dipping into their overdraft. A prepaid card is a useful way for them to access funds ahead of schedule.

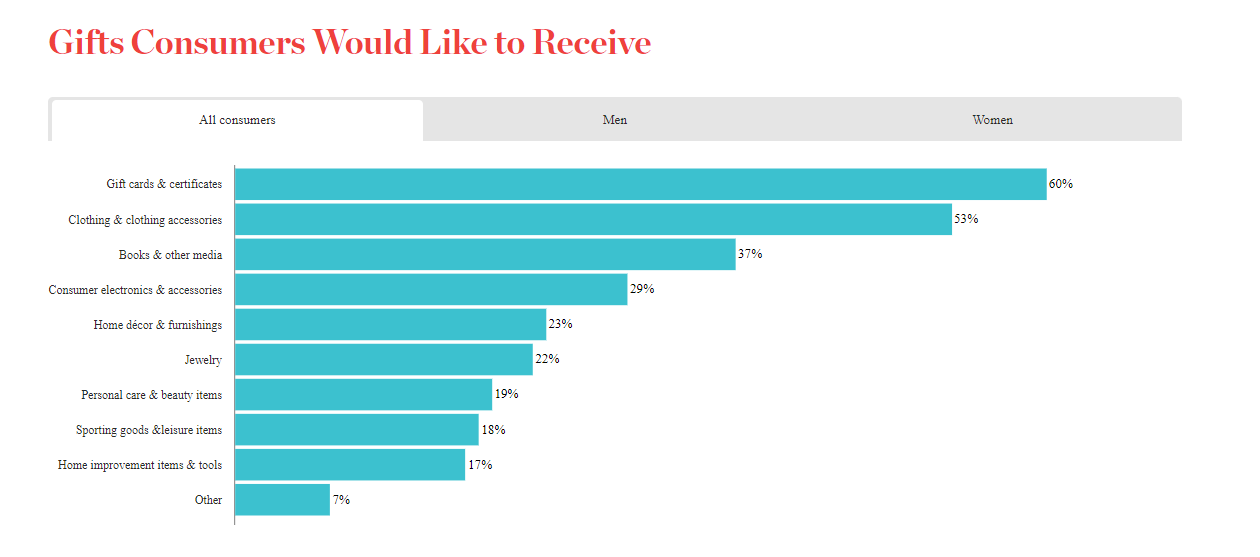

A prepaid card might also act as a gift card with the user able to shop at multiple locations. This is often a hit with employees and small wonder: a survey from the National Retail Federation found that gift cards are the present most consumers would like to receive.

Source: National Retail Federation

Activating ATM withdrawals and expanding a card’s reach into several affiliated storefront locations is a smart move for card issuers.

Give the employee full autonomy

Handing an employee an individual card doesn’t mean much when you impose too many limits on them. Spending controls are useful, but only within reason, such as for security. Treat employees as adults.

Empowering employees with the autonomy to use their individual cards within a set framework enhances their user experience and also encourages a sense of ownership and accountability.

This heightened respect and trust contributes to a healthy work dynamic where employee satisfaction is likely to be higher.

How Berkeley Payments’ prepaid card leads to big returns via enhanced employee satisfaction

Digital, instant, and convenient, a growing number of top companies are turning to Berkeley’s business prepaid debit cards for employees as a way of boosting morale and productivity.

But don’t just take our word for it, check out these three recent success stories that illustrate just how much an impact our prepaid card service has had on our clients.

Harnessing the power of sales incentives: LG's Success Story

International electronics firm LG needed to upgrade its incentive program so that sales agents were motivated to hit demanding targets.

It onboarded Berkeley’s easy prepaid card system, which allowed them to swiftly deliver rewards free from the paperwork and manual logjams that held up previous rewards processes.

The transition quickly paid off. Now, via a simple LG portal, sales agent cardholders can submit their sales data and get their rewards uploaded to their Visa card immediately. This seamless process has made it super convenient and motivating for the sales team, who know they’ll get their kickback as soon as they make a sale.

Delivering a spark of excitement among staff, this change has made the sales environment livelier and more competitive. Faced with fewer hassles and quick rewards, LG staff have contributed to a big jump in agent performance and overall sales.

Like the smart phones they sell, LG's smart move shows how upgrading innovation and efficiency can produce remarkable results.

Making Waves with Ceridian's Gig Payments Solution

Ceridian is a global HR management software company that knows a thing or two about how to streamline HR processes.

Its management wanted to create a way for employees to request wage advances whenever they wanted, so they teamed up with Berkeley’s Platform-as-a-Service (PaaS) to offer an innovative gig payments solution.

Integrated into their Dayforce Wallet, this smart system loads approved funds onto a Ceridian-branded Mastercard in real-time. Users can carry out hassle-free spending, ATM withdrawals, and ETF investments with the card, as well as manage their funds as they see fit.

Seamless, efficient, and user-friendly, Ceridian now has a company card that’s a shining example of empowered employee spending.

Ceridian’s corporate company card

Sales Rewards with Optiom's Corporate Reloadable Incentive Card

In the world of car insurance sales, top agents are at a premium and need to feel valued if they’re to stick around.

Optiom stepped up its employee rewards game with its Corporate Reloadable Incentive Card. Not only do agents get instant sales commissions loaded to their card, but they can also switch funds to their external bank account using the DirectSend features (powered by the smart e-transfer system CARTA).

Sleek and efficient, the incentive card has proved to be the ultimate tool in keeping agents motivated to hit demanding sales targets.

Empower Your Team with Berkeley's Prepaid Cards for Employees

Incentivizing your employees is tough in a remote work environment.

Whereas in the past, a face-to-face meeting, a fridge full of treats paid out of petty cash, or team bonding exercises were enough to boost morale, today’s scattered workforces are more difficult to engage with directly.

Berkeley’s prepaid cards for employees offer you a route to connect and reward your team which companies often lack in today’s digitized environment.

Easy-to-use, versatile, and designed in your brand’s image, they empower your staff to make their own purchasing and investment decisions, while also strengthening your brand visibility and appreciation.

Here’s how.

Provide the best cardholder experience

Hand your staff a sense of financial empowerment with full control over how they spend their Berkeley card credit.

Whether for work-related expenditure or personal spending, employees can manage their finances via personalized account access and a full transaction history overview.

They can also choose to get notifications that inform them of card top-ups and payments.

Bank-like convenience, with no fees

Can you imagine a business bank account with no ownership expenses or hidden fees? Us neither.

Yet this is exactly what our prepaid cards provide. We partner with financial institutions that are members of FDIC and operate within the Visa or Mastercard networks, providing your workers with access to digital banking transactions without financial and security worries.

Increase exposure with full customization

Adorned with your company colors and logo, your prepaid cards will become an extension of your brand’s identity, whether you’re a multinational corporation or a small business.

Every time your employee uses it, they’ll be positively reinforcing your brand to themselves and those around them, impressed by your company name on a Mastercard or Visa debit cards.

Quick and Efficient Delivery

Access Berkeley’s card portal to issue cards in a matter of clicks.

Not only will your employees receive physical cards promptly thanks to our swift delivery process, but they’ll also get instant access to our exclusive mobile app where they can access real-time transaction details, set spending limits, and manage their expenses on the go.

You can also choose to issue virtual cards which offer a full digital spending experience.

Effortless reporting and tracking

Berkeley’s card portal is the gateway to powerful reporting tools that provide data on employee spending behaviors.

Via a user-friendly interface, you can access expense management features that rival the capabilities of accounting software like Xero and Quickbooks. These include up-to-date expense reports and detailed transaction histories that make bookkeeping much easier.

How to launch your Prepaid Employee Card today

If you associate launching a card program with a stressful and expensive set-up process, then we don’t blame you — many of them are.

Berkeley’s prepaid cards for employees, though, are designed differently. We use a single-integration API to connect you to our banking infrastructure without the technical hiccups that plague other banking solutions.

Once on board, you’ll get full access to the PayHub Portal from where you can issue cards, emburse employee accounts via direct deposits, and chat to our finance team who are on hand in case of any issues.

In short, a ready-made card program that is positioned to deliver impactful results right away.

Want to find out how Berkeley’s prepaid cards for employees can push productivity through the roof at your company? Sign up today and set up a rewards program that unlocks the full potential of your workforce.